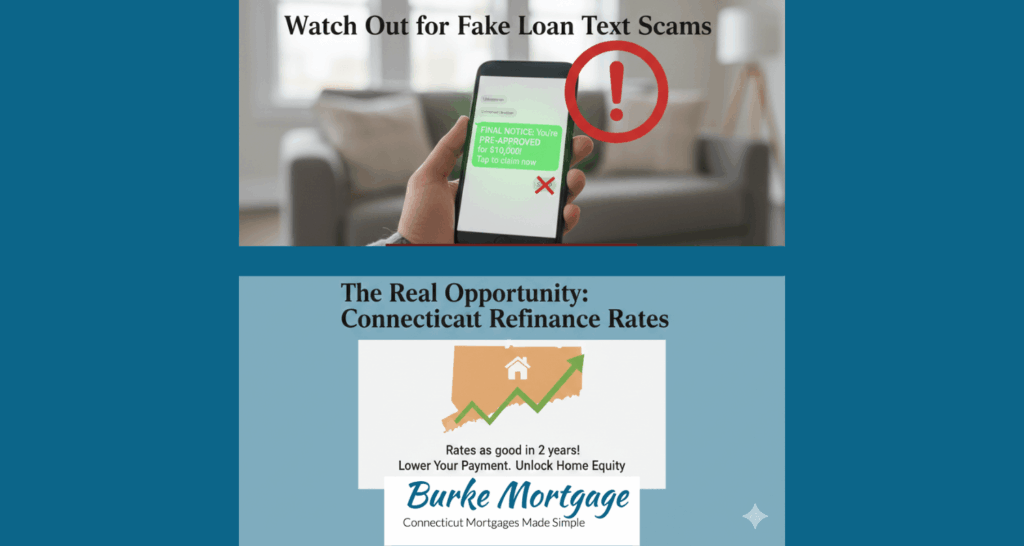

Protect yourself from Connecticut mortgage scams. Learn how to spot scam texts and explore legitimate, statewide refinance options with Burke Mortgage.

Category: Mortgage ReFi Info

Mortgage and Refinance loan information. Detailed information on different loan types, eligibility requirements, and interest rates.

VA Loans Empower CT Veterans to Buy Homes

Burke Mortgage honors Veterans Day by helping Connecticut veterans unlock homeownership through powerful VA loan benefits like zero down payment and no PMI.

Quick Credit Tips: Boost Your Score and Secure Your Future

Discover how payment history, balances, credit age, and inquiries impact your score.

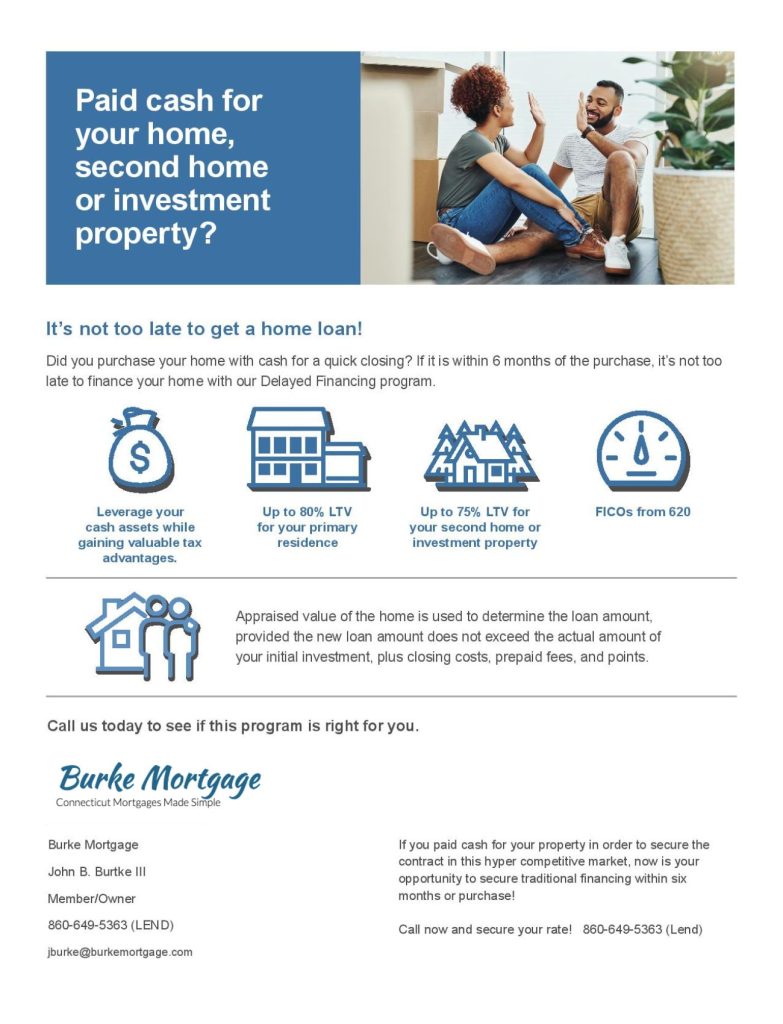

Buy Now, Mortgage Later: The Delayed Financing Strategy

Discover how delayed financing can offer unique benefits for homebuyers.

Understanding the Role of Mortgage Brokers vs. Mortgage Lenders

A mortgage broker acts as an intermediary between you and multiple mortgage lenders. Learn more…

What is a Reverse Mortgage?

Burke Mortgage can help you determine if a reverse mortgage is right for you. Call to discuss your current situation & plans to stay in your own home.

What Happens to Your Mortgage Debt When You Die?

Find out what happens to your home, mortgage, your estate after you die.

The Most Frequently Asked Questions About Mortgages

The most common questions about mortgages typically revolve around understanding the process, terms, and implications of taking out a home loan.

Why Should I PreQualify for a Mortgage?

Prequalifying for a mortgage offers numerous benefits throughout the home-buying process.

Did you pay cash for your home or investment property?

If you paid cash for a property delayed financing may off an opportunity for you. Ask Burk Mortgage about delayed financing, call 860-649-5363 (LEND)