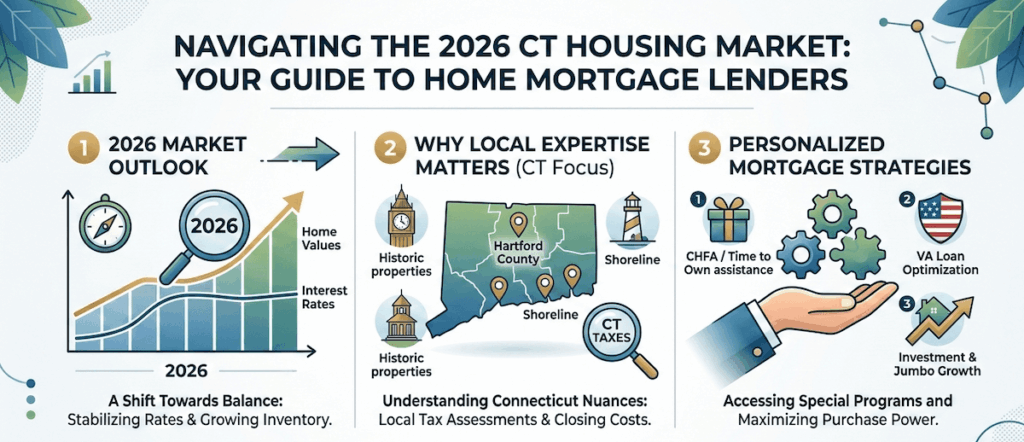

As 2026 brings a more balanced housing market to the Nutmeg State, finding the right home mortgage lenders in CT is the first step toward securing your dream home. From shifting rates to new down payment assistance options, here is what you need to know.

Category: Industry News

Mortgage industry updates, market trends, and local Connecticut regulations.

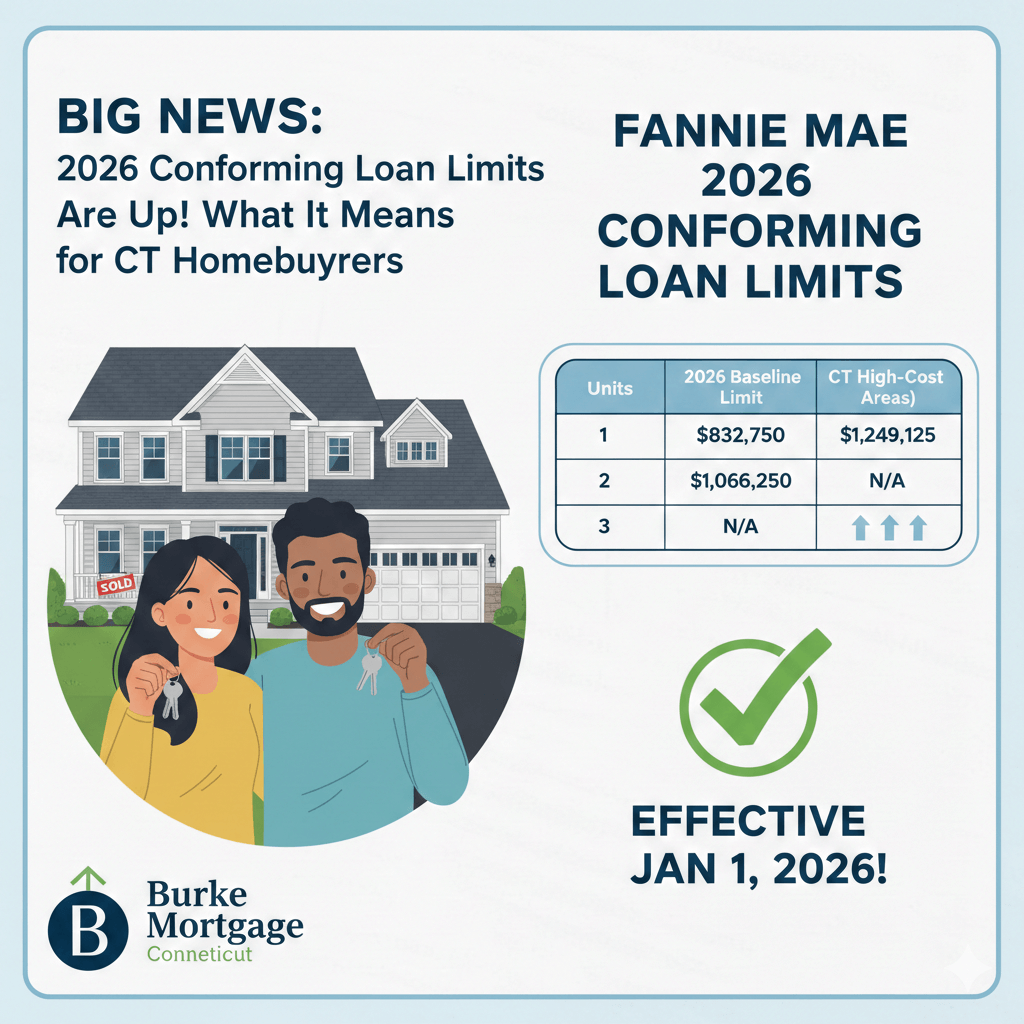

2026 Conforming Loan Limits Are Up! What It Means for CT Homebuyers

Fannie Mae has announced significantly higher 2026 Conforming Loan Limits—including a $832,750 baseline for 1-unit properties—effective January 1st, expanding conventional financing options for Connecticut homebuyers.

Connecticut Real Estate Trends: October 2025 Market Update

Connecticut’s housing market cooled slightly this October, giving buyers more leverage and opening new opportunities for refinancing at easing mortgage rates.

Finding the Right Mortgage in Connecticut: Burke Mortgage Makes It Simple

Burke Mortgage offers a wide range of home loan options in Connecticut, including FHA, VA, reverse, and jumbo loans. Learn which one may be right for you.

Unlock Your Connecticut Summer Dream Home with Burke Mortgage

Discover how Burke Mortgage can help you secure your dream home in Connecticut this summer, from understanding unique market conditions to accessing specialized loan programs.

Connecticut Tackles Housing Shortage with School Conversions and New Development Trends

Explore Connecticut’s housing shortage, school conversions, and real estate trends in 2025—key insights for buyers across all eight counties.

Get Pre-Approved for Spring Open House Season in Connecticut

Looking to buy a home in Connecticut? Get pre-approved for spring open house season with Burke Mortgage & gain the confidence to make fast, competitive offers.

2025 CT Loan Limit Increases!

Great news for Connecticut homebuyers! Fannie Mae and Freddie Mac have announced increased conforming loan limits for 2025, allowing you to borrow more for your dream home. Learn what these changes mean for one- to four-unit properties across the state.

Interest Rates Are Dropping: Is It Time to Refinance Your Mortgage?

The recent decline in interest rates could benefit you.

Is a Reverse Mortgage Right for You in 2024?

Connecticut seniors facing financial challenges in a hot real estate market? Learn if a reverse mortgage can help.