Great news for Connecticut homebuyers! Fannie Mae and Freddie Mac have announced increased conforming loan limits for 2025, allowing you to borrow more for your dream home. Learn what these changes mean for one- to four-unit properties across the state.

If you’re planning to buy a home or refinance in 2025, here’s exciting news: Fannie Mae and Freddie Mac have raised their conforming loan limits! These increases reflect rising home prices and aim to make homeownership more accessible. As a mortgage broker serving Connecticut, I’m here to break down what this means for you.

What Are Conforming Loan Limits?

Conforming loan limits are the maximum loan amounts eligible for purchase by Fannie Mae and Freddie Mac. These limits vary by county and property type, covering one- to four-unit properties. Staying within the conforming limits can offer better rates and terms compared to jumbo loans.

New 2025 Loan Limits in Connecticut

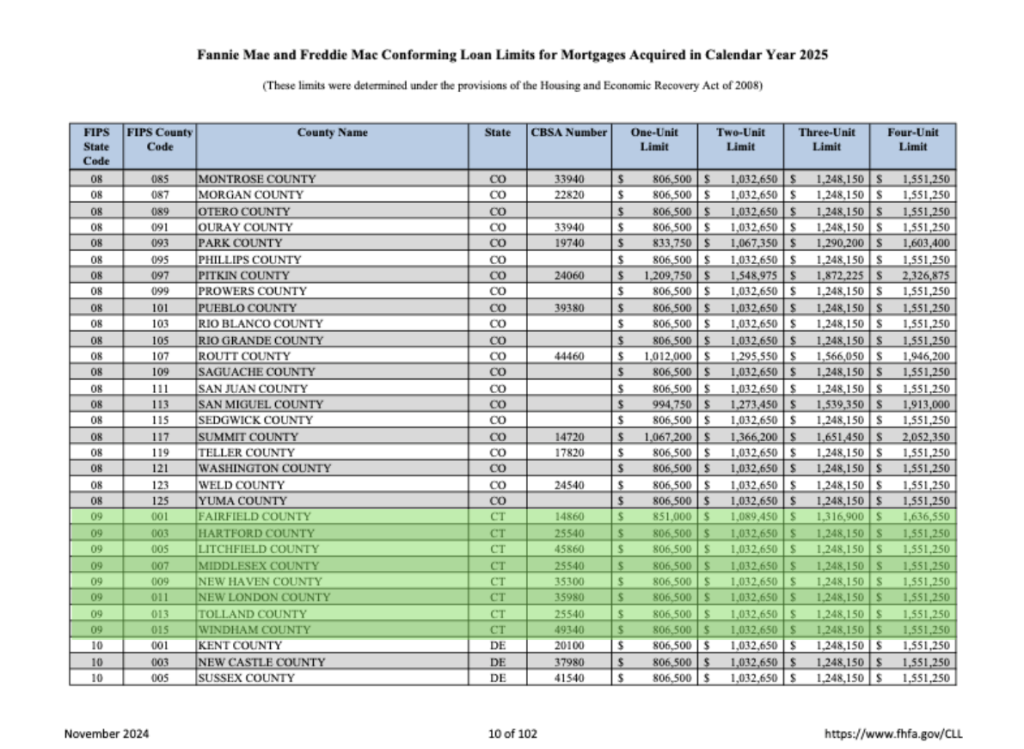

In 2025, the Federal Housing Finance Agency (FHFA) raised the loan limits for Connecticut. Here’s an overview:

What This Means for Homebuyers

For buyers, these higher limits mean you can finance more without needing a jumbo loan. For instance, Fairfield County’s one-unit limit of $1,089,300 allows for a larger conforming loan, ideal for purchasing or refinancing in high-cost areas.

Get Started Today!

At Burke Mortgage, I can guide you through understanding these limits and finding the right mortgage for your needs. Let’s explore how these changes can benefit you. Contact Burke Mortgage!