More than 15 million people live in households that may owe as much as $20 billion to their landlords.

Author: Burke Mortgage

Home Sales Highest Level since 2005

Home sales still strong…

We Can Now Offer Fannie Mae RefiNOW

Beginning June 5th, Fannie Mae announced a new refinance option, RefiNOW.

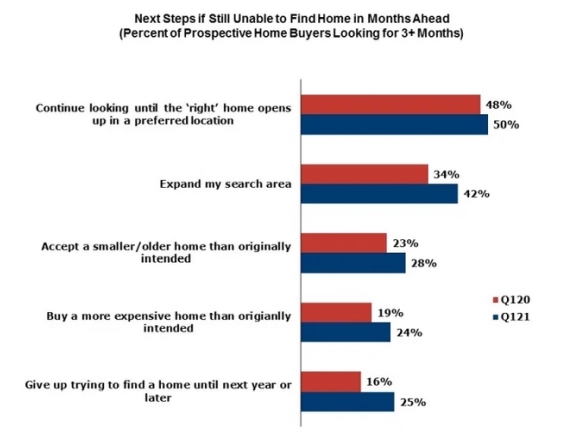

What Consumers say they will do if they can’t Find A House

What people are doing if they can’t find a home in this HOT housing market.

The Connecticut housing market remains HOT!

With limited stock available, potential buyers are often outbidding each other OVER and ABOVE the listed price.

Rise in Home Values Negating Low Mortgage Rates

Homes priced below 75% of the local median price had 14% annual appreciation, negating most of the benefits of record-low mortgage rates.

2021 Mortgages Getting Off to a Great Start

More and more people are closing on new homes. And Burke Mortgages is getting 5-STAR reviews! Connecticut’s housing market is as HOT as it has been in over a decade! Buyers are buying and sellers are selling. Best advice for sellers? It’s still very important that you make a positive first impression from the outside Read More

Mortgage Testimonial from Enfield CT

A happy first time homeowner shares a five-star review on Zillow for John Burke of Burke Mortgage.

Generational Credit Score Averages Going UP!

Reports from Experian say that ALL generations have boosted their credit score averages by 1-11 points from 2019 through 2020!

PSA: Identity Theft

Often someone finds out that they are a victim of identity theft when they are in the middle of applying for a mortgage. Learn more.