A mortgage broker acts as an intermediary between you and multiple mortgage lenders. Learn more…

Category: CT Home Loans

Connecticut Real Estate Market Update: Buyers vs. Sellers

Connecticut’s housing market in 2024 is a tale of two sides. Here’s a quick breakdown of the key trends for buyers and sellers…

Urgent: Support the Homebuyers’ Privacy Protection Act Today!

Supporting the Homebuyers’ Privacy Protection Act S.3502 Can Help End Trigger Leads As a Connecticut-based mortgage professional, John Burke and the entire Burke Mortgage team are committed to championing the cause of consumer privacy. Your advocacy will contribute to the collective effort to end the practice of unsolicited trigger leads, safeguarding the privacy of consumers Read More

Connecticut Mortgage Broker Burke Mortgage Welcomes 2024 Loan Limit Increases!

Exciting news for homebuyers and homeowners in Connecticut, as the FHFA, in tandem with Fannie Mae & Freddie Mac, announced an increase in loan limits.

The Most Frequently Asked Questions About Mortgages

The most common questions about mortgages typically revolve around understanding the process, terms, and implications of taking out a home loan.

Why Should I PreQualify for a Mortgage?

Prequalifying for a mortgage offers numerous benefits throughout the home-buying process.

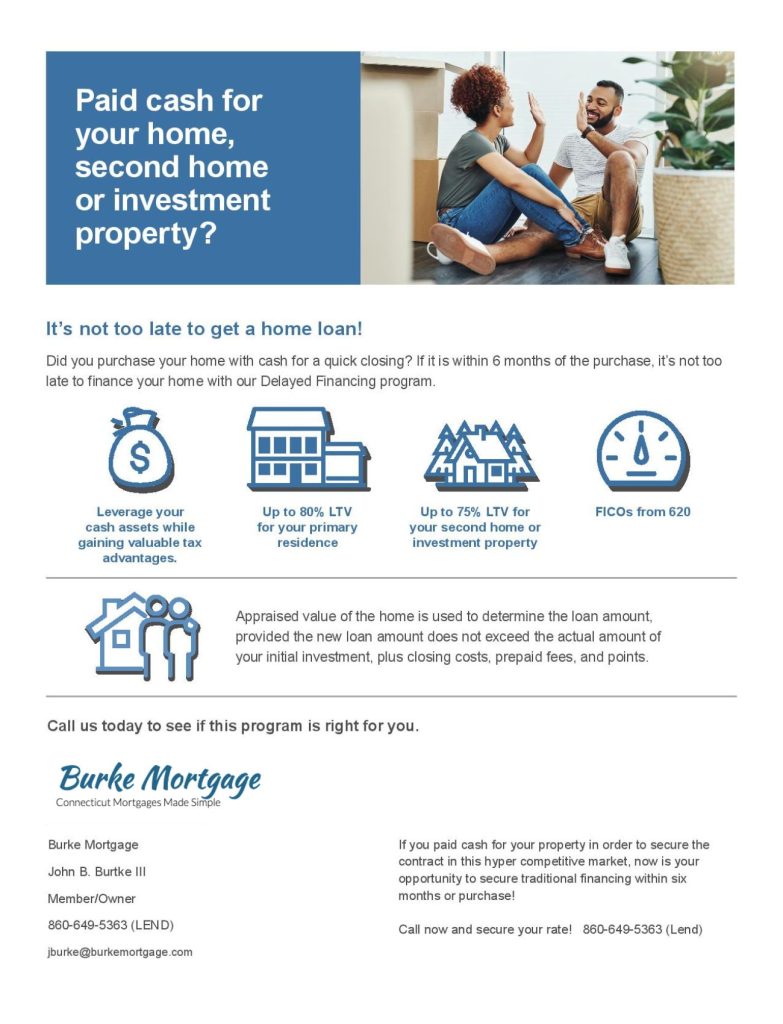

Did you pay cash for your home or investment property?

If you paid cash for a property delayed financing may off an opportunity for you. Ask Burk Mortgage about delayed financing, call 860-649-5363 (LEND)

FHA Financing News

Great news for Home Buyers seeking FHA Financing!! In an effort to reduce the nations’ home affordability challenges, FHA will lower its annual Mortgage Insurance Premium by .30% -from .85% to .55%! This change will take effect on March 20 and is expected to save FHA loan borrowers, primarily low- and middle-income and first-time buyers, an Read More

What Happens to Your Mortgage Debt When You Die?

Find out what happens to your home, mortgage, your estate after you die.

Great FHFA News

The FHFA recently announced…