The Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA), and Department of Veterans Affairs (VA) have issued new, higher loan limits for 2018.

Franklin American Mortgage Company (FAMC) sent us this update that we wish to share with you. The timeframes and processes for implementing these higher loan amounts:

- Conventional Conforming loans locked/registered beginning December 4, 2017;

- FHA loans with case numbers assigned on or after January 1, 2018; and

- VA loans locked/registered beginning December 18, 2017 and closing on/after January 1, 2018.

Conventional Conforming Loan Limits

The following tables outline the difference in maximum loan limits from 2017 to 2018, based on the number of units, for Standard and High Balance/Super Conforming loans.

FHA Hikes Loan Limits

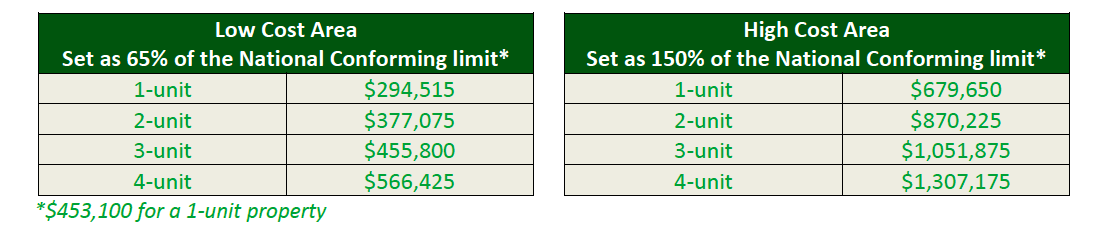

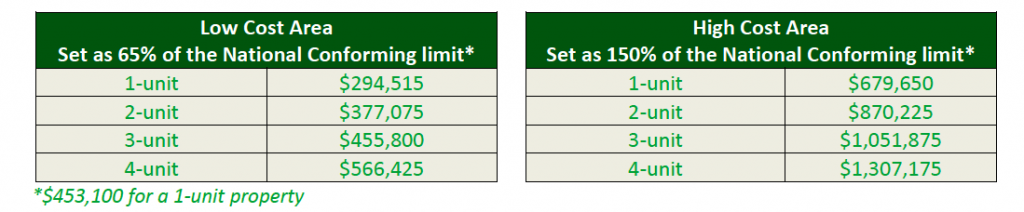

The following tables reflect the 2018 FHA loan limits, effective on or after January 1, 2018:

As was the case recently for conventional conforming loan amounts, loan limits on forward and reverse mortgages insured by the Federal Housing Administration have been boosted for next year. FHA floor loan limits are determined based on 65 percent of conforming limits on residential loans that are acquired by Fannie Mae and Freddie Mac. Late last month, the regulator and conservator of Fannie and Freddie, the Federal Housing Finance Agency, reported that the 2018 conforming limit has been set at $453,100.

On Thursday, the Department of Housing and Urban Development issued a letter indicating that the FHA floor limit on forward mortgages for next year on one-unit properties will increase to $294,515 from $275,665 in 2017. This floor applies to those areas where 115 percent of the median home price is less than the floor limit,” the letter stated. “Any areas where the loan limit exceeds this ‘floor’ is considered a high-cost area, and FHA sets its maximum loan limit ‘ceiling’ for high-cost areas at 150 percent of the national conforming limit.” In high-cost areas, the one-unit ceiling limit is increasing to $679,650 in 2018 from $636,150 last year.

Thanks to rising home prices, FHA loan limits are increasing in 3,011 counties, while no change will occur in 223 counties. HUD also issued a letter indicating that the maximum claim amount limit for FHA-insured home-equity conversion (reverse) mortgages will be $679,650 next year.

Source: Mortgage Daily and Franklin American Mortgage