In a recent press release from the Federal Housing Finance Agency (FHFA), house prices have risen 18.7% from the first quarter of 2021 to the first quarter of 2022. The FHFA House Price Index (FHFA HPI®) were up 4.6% compared to the fourth quarter of 2021. more in their press release “U.S. House Prices Rise Read More

Category: Industry News

Mortgage industry updates, market trends, and local Connecticut regulations.

Home Equity

As home values continue to increase in Connecticut many homeowners now have equity in their homes. Home Equity FAQs.

November 2021 Interest Rate NEWS

News flash……interest rates are on the rise as is inflation. If you are considering refinancing, there is no time like the present as rates are still at historical lows!

Frenzied Real Estate Buying in CT!

Connecticut’s housing market hottest in the country right now!

A huge spike in home renovations

Observations on recent increases in home renovations and the current housing boom.

CDC Eviction Moratorium Ends

More than 15 million people live in households that may owe as much as $20 billion to their landlords.

Home Sales Highest Level since 2005

Home sales still strong…

We Can Now Offer Fannie Mae RefiNOW

Beginning June 5th, Fannie Mae announced a new refinance option, RefiNOW.

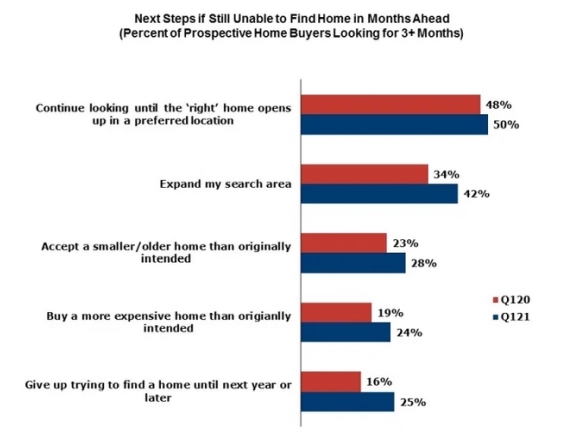

What Consumers say they will do if they can’t Find A House

What people are doing if they can’t find a home in this HOT housing market.

The Connecticut housing market remains HOT!

With limited stock available, potential buyers are often outbidding each other OVER and ABOVE the listed price.